Comment

Turley welcomes increasing alignment and clarity on GHG Accounting and Reporting Standards

Technical Guidance for the Financial Industry (TGFI) was released on 14 March, authored by collaborators from the Partnership for Carbon Accounting Financials (PCAF), Carbon Risk Real Estate Monitor (CRREM) and GRESB. This is hugely welcomed by our ESG Director, Snigdha Jain who supports the standardised and harmonised Technical Guidance, outlining best practice and offering recommendations to financial institutions for the accounting and reporting of real estate-related emissions.

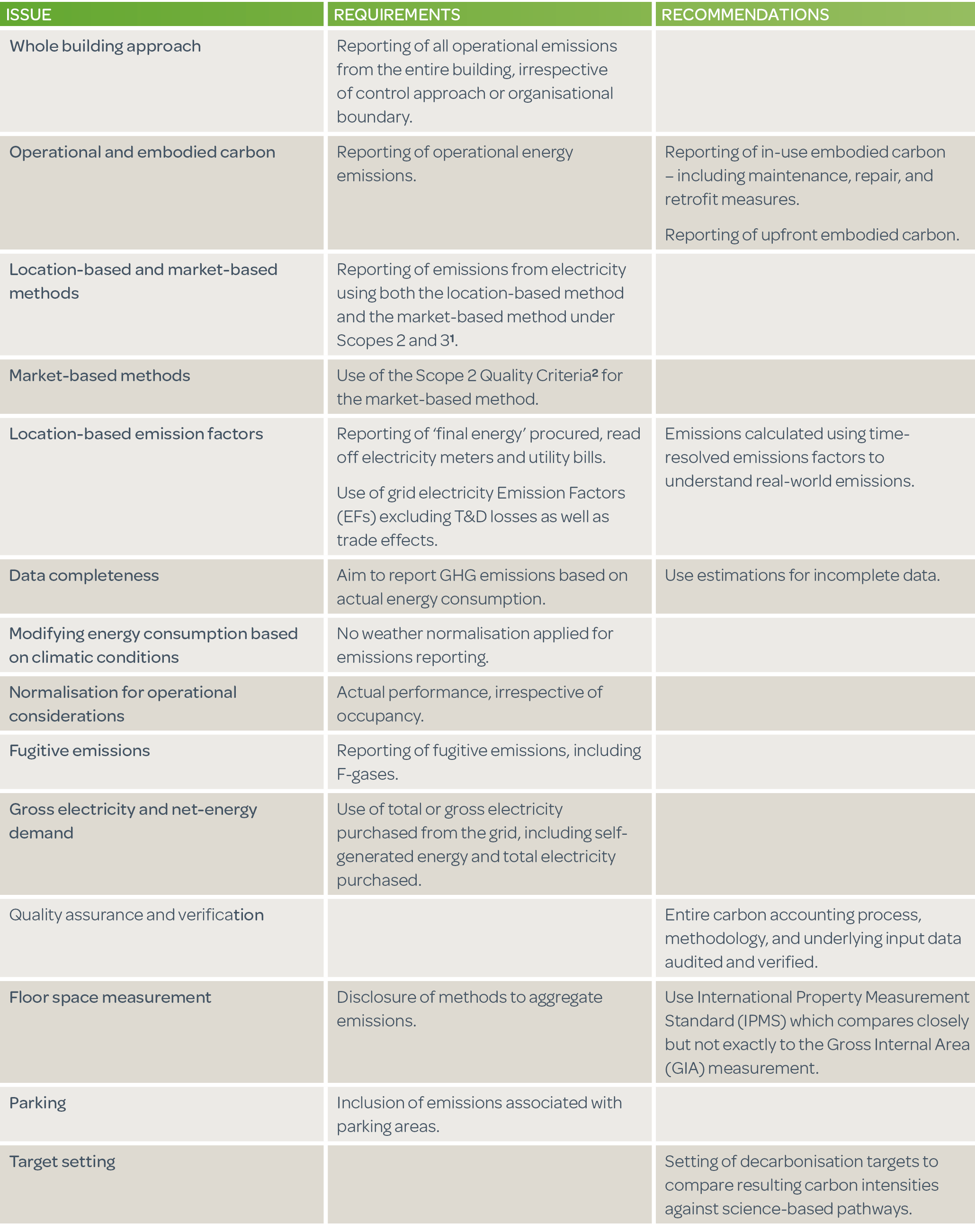

The recommendations within the guidance are clearly differentiated between what is required and what is recommended for GHG accounting, and a summary provided below.

‘Requirements’ for GHG accounting are those in line with the GHG Protocol and the PCAF Standard whilst ‘Recommendations’, are often at times best practice, but not a strict requirement.

The guidance gives great insight into some key trends that are starting to emerge and become mainstream in relation to GHG reporting, in the context of real estate operations and these include:

Streamlining

Any standard, framework or set of recommendations is increasingly streamlined against all major global initiatives, as evidenced by this guidance document being prepared following engagement with the GHG Protocol[3], the UN-convened Net-Zero Asset Owner Alliance[4] and the Science-Based Targets initiative (SBTi)[5]. This is crucial to ensure alignment in the underlying approach and to not delay climate action in the real estate sector.

Whole Building Approach

The guidance requires reporting using the whole building approach, which includes operational emissions for the entire building from both landlord and tenant emissions.

This aims to resolve any ambiguity regarding the interpretation of organisational boundaries or operational control. It does concede though that there can be delineation between Scope 1, 2 and 3 emissions to gain a better understanding of the drivers of transition risk.

Rise of Embodied Carbon

Whilst the focus of the guidance is on operational emissions, it recognises that embodied carbon and emissions over the entire life cycle of buildings are extremely important and hints at this being mandated in the future. Measuring and reporting embodied emissions in the built environment is fast becoming the norm for companies aspiring to align with best practice, and there is an increasing amount of guidance around accounting methodologies seeking to propel disclosure efforts[6].

Move to time-resolved emissions factors

The guidance recognises the inadequacies of the carbon accounting approach in areas with decarbonising grids with seasonal, daily and hourly variations in location-based emission factors. This will become increasingly crucial as we seek to understand real-world emissions, as opposed to emissions based on a static annualised calculation approach.

Ultimately, the guidance provides a clear and comprehensive approach to GHG reporting, identifying material areas and providing guidance on challenges specific to the real estate space.

For a discussion on best practice guidance around GHG measurement, reporting, verification or alignment with net zero targets, please get in touch with ESG Director, Snigdha Jain or Director and Head of Sustainability, James Blake.

29 March 2023

[1] Relevant scope 3 categories include Category 13: Downstream leased assets and Category 15: Investments

[2] https://ghgprotocol.org/scope_2_guidance

[4] https://www.unepfi.org/net-zero-alliance/

[5] https://sciencebasedtargets.org/

[6] One such effort is the Sector Supplement for Measuring and Accounting for Embodied Emissions in the Built Environment A Guide for measuring and reporting embodied emissions using the Greenhouse Gas Protocol version 1.1 - November 2021 wri-embodied-emissions-sector-supplement-2022_1.pdf (ghgprotocol.org)